Decoding NFT: LateDAO shows the real potential of NFT

It’s easy for one to presume that the returns of NFT only reflect on the money you can gain from buying and selling, or to be exact, buy at ‘floor price’ and sell for quick profits. However, it’s just part of the truth.

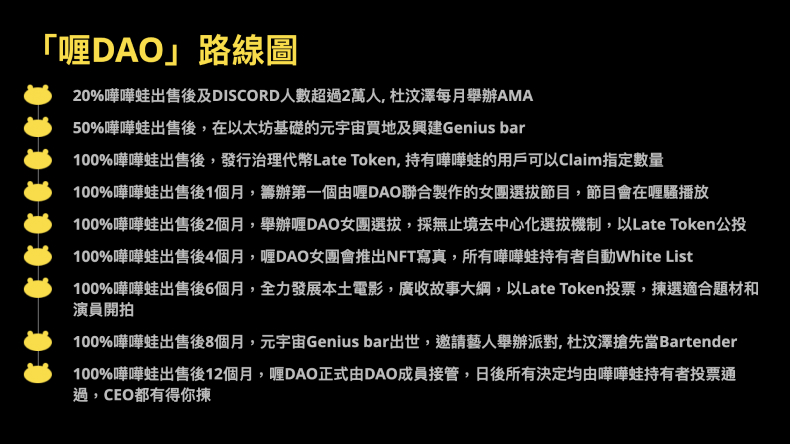

The ‘Late DAO’ that was introduced before can serve as an instance. Integrating the concept of DAO into the development vision of a ‘Late Show’ entertainment kingdom, the NFT series allows the stakeholders to experience the procedure of joint decision-making, joint discussion, and joint governance. And after Late Show announced the detailed roadmap of Late DAO, we can have a better understanding of the project’s ambition and the potential returns of the stakeholders.

To understand this ambition, one should know the nature of NFT. NFT is a record on the blockchain and the owner's wallet address can be traced according to this record. In other words, NFT is a proof of ownership; if you own a specific NFT, it means that you belong to a small community group and are able to enjoy certain benefits.

According to the Late DAO roadmap, when 20% and 50% of the NFT works are sold, monthly events will be held, and a Genius Bar in Metaverse will be established for members’ gatherings; when all NFTs are sold, a governance token, Late Token, will be issued and a designated amount will be distributed to NFT holders. Last but not least, NFT holders will be automatically included in other NFT ‘whitelists’ that derived from the original one. And the ultimate goal is for DAO members to take over the entire DAO, at that time, all decisions will be decided by voting.

Three major revenue for Late DAO NFT holders can be easily concluded. First, ‘membership’. It allows holders to participate in different member-exclusive activities and enjoy membership benefits such as ‘whitelist’.

Second is the distributed Late Token, which allows holders to participate in voting and decision-making. If we place this idea under a stock market context, early DAO participants are equal to early shareholders: they enlarge the capital pool by buying NFTs, enjoy membership benefits, and receive Late Tokens—similar to stock dividends, but instead of not real ‘money’, the stock dividends are those rights and membership benefits. But what if Late DAO develops into an entertainment kingdom in the future?

Third, the Late Token is not only benefits and voting token but also token that could be sold to the public. NFT holders, thus, will be able to enjoy the most incalculable return: the increase of Late Token price that driven by market demand. In other words, the Late Token issued by the Late DAO is as attractive as the ‘dividends’ we used to earn in the stock market, but the thing is, the cryptocurrency is proved as a great tipper.

It is less than one year since NFT pops up and becomes a hot topic. This amazing result, indeed, is not only due to the promotion by different big names but also the commercial adoption by enterprises. When the application of NFT becomes more and more extensive and inseparable from daily life, apart from paying attention to the immediate benefits, we should also take a long-term view and look forward to those more impressive potential revenues.