Report: Bitcoin "severes ties" with US stocks

According to the latest report from on-chain data analysis firm CryptoQuant, Bitcoin has undergone a structural market shift in the second half of 2025, with the most significant change being a notable decoupling from the U.S. stock market, specifically the S&P 500 index. This phenomenon is not a short-term fluctuation but reflects a fundamental change in capital inflow patterns and market structures.

Structural Decoupling of Bitcoin from U.S. Stocks: Moving from "Risk Assets" to an Independent Market

The report indicates that Bitcoin has entered a consolidation phase characterized as "weak to neutral," but systemic risks are limited. While price activity may be subdued, underlying structural changes have significantly reduced downward pressure and have not triggered new speculative behavior. The introduction of a spot Bitcoin ETF is one of the main drivers of this decoupling, shifting market demand from past short-term speculative trading linked to the U.S. stock market to a "allocation-focused capital flow" independent of stock market trends.

Shift in Leverage Structure: Stablecoins Replace BTC as Primary Collateral

The leverage dynamics in the market have also undergone a critical shift:

- The derivatives market increasingly relies on stablecoins as collateral, leading to a decline in high-leverage positions priced in BTC.

- This transition has reduced the risk of "cascading liquidations" and has interrupted the transmission of stock market volatility to the Bitcoin market.

At the same time, macro liquidity is shifting towards commodities and precious metals, causing Bitcoin to be temporarily marginalized, leading to a weakened response to stock market sentiment.

Structural Solidification of Holders: Long-Term Investors and ETF Custodians Dominate the Market

The report further reveals that the nature of market participants is changing:

- Short-term trend traders who view Bitcoin as a "stock alternative" continue to exit the market.

- Long-term holders and ETF-related custodians have become the main holders, reinforcing the stability of the supply side.

- The price discovery mechanism has shifted to being "endogenously driven," increasingly relying on holding behavior and supply constraints rather than external macro signals.

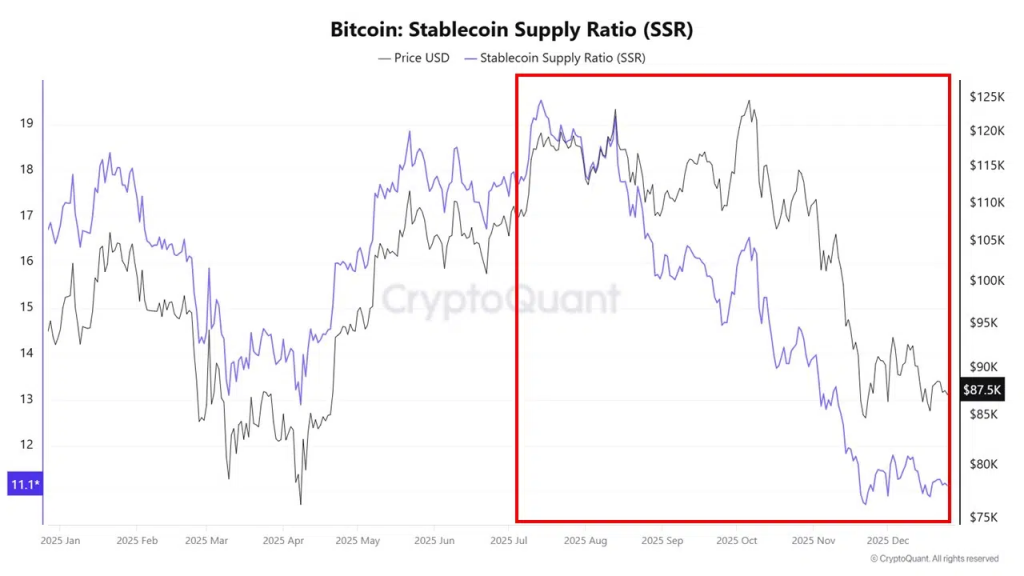

Key Indicator: Hidden Strengthening of Stablecoin Purchasing Power

Despite weak price performance, the stablecoin supply ratio (SSR) has continued to decline during the same period, indicating that the potential purchasing power of stablecoins is accumulating. This suggests that capital remains within the cryptocurrency ecosystem rather than flowing significantly into the stock market. The baseline scenario set in the report is that the market will continue consolidating under "tepid demand," rather than "forced selling pressure," unless the market accumulates high leverage again or stablecoins begin large-scale deployment.

Conclusion: A New Price Logic Has Taken Shape

The report clearly concludes that the decoupling of Bitcoin from U.S. stocks is structural. The previously tight connection between the two has been significantly removed, and the price response pattern of Bitcoin during periods of macro uncertainty has been fundamentally reshaped.