The truth behind Wall Street's crazy rush for Circle shares

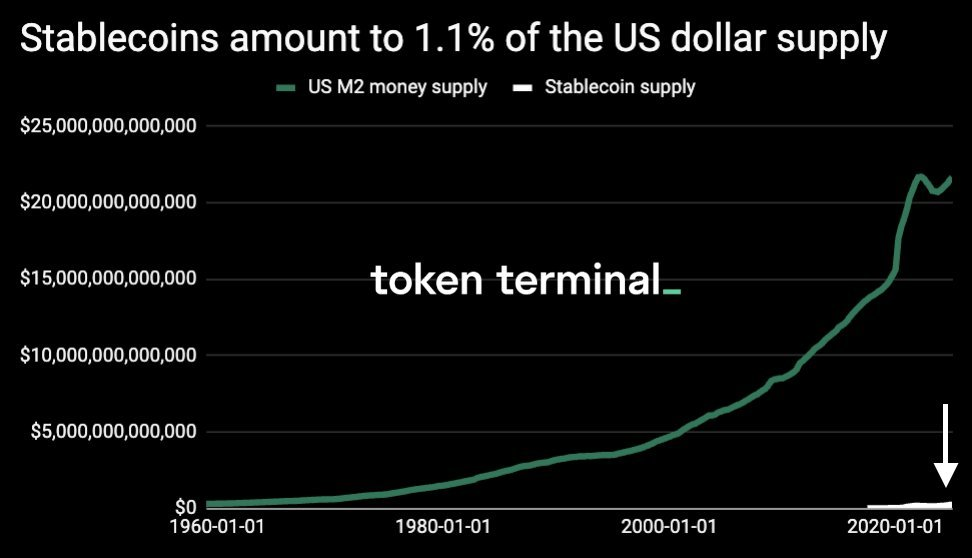

Since its IPO on June 4, 2025, Circle Crypto, the issuer of the USDC stablecoin, and its CRCL stock have seen a remarkable 7-fold increase in share price (after last Friday's market close) compared to its initial offering price. This surge coincides with the robust growth of the stablecoin market, highlighting its expanding influence. According to Token Terminal data, stablecoins currently account for 1.1% of the U.S. money supply (M2). While seemingly small, this percentage signifies their growing importance within the global financial system. Furthermore, CoinDesk data from mid-June shows that the global market capitalization of fiat-backed stablecoins has surpassed $250 billion, a record high, sparking widespread discussion about their potential to reshape global finance.

Token Terminal predicts that stablecoins' share of the overall money supply will continue to rise, potentially approaching 100%, reflecting the industry's ambition to integrate programmable digital assets into mainstream financial infrastructure.

Over the past decade, the supply of stablecoins has experienced explosive growth, contrasting sharply with the long-term expansion of the U.S. dollar, indicating the rapid adoption of blockchain-based digital dollars. CoinDesk's mid-June data confirms this, reporting a record-breaking $250 billion market cap for global fiat-backed stablecoins. CryptoQuant's data from early June also reached a record high of $228 billion, demonstrating the significant influx of capital into USD-pegged stablecoins.

The stablecoin market capitalization exceeding $250 billion showcases the substantial inflow of funds into USD-pegged stablecoins.

Compared to the same period last year, this represents approximately a 55% increase. Since the beginning of 2025, stablecoin market capitalization has grown by $33 billion (a 17% increase). CoinGecko data further indicates a $97 billion increase since January 2024, primarily driven by Tether's USDT and Circle's USDC, with emerging player Ethena Labs accumulating nearly $6 billion in assets. Centralized exchanges currently hold a record amount of stablecoins, further enhancing liquidity in the cryptocurrency market.

The applications of stablecoins extend beyond trading, penetrating broader financial sectors. Fireblocks' "2025 State of Stablecoins" report reveals that 49% of global financial institutions utilize stablecoins for payments, with another 41% testing or planning integration, indicating a shift from niche concept to a core component of payment and financial infrastructure.

Payment giants like Visa and Mastercard have integrated stablecoins, and stablecoins such as USDC, USDT, and PYUSD are increasingly used in cross-border payments. Governments are actively exploring regulatory frameworks for CBDCs (Central Bank Digital Currencies) and stablecoins. These trends point towards stablecoins playing an increasingly crucial role in the future financial system.