Rich Dad reveals he hasn't bought Bitcoin or gold in years

The famous personal finance book author Robert Kiyosaki, known for "Rich Dad Poor Dad," recently sparked widespread controversy with his comments on the social media platform X. He revealed that he has not purchased gold or Bitcoin for several years and only recently bought silver. This statement contradicts his long-standing public advocacy for a "buy continuously" strategy, prompting followers to question the credibility of his claims and whether they are misleading.

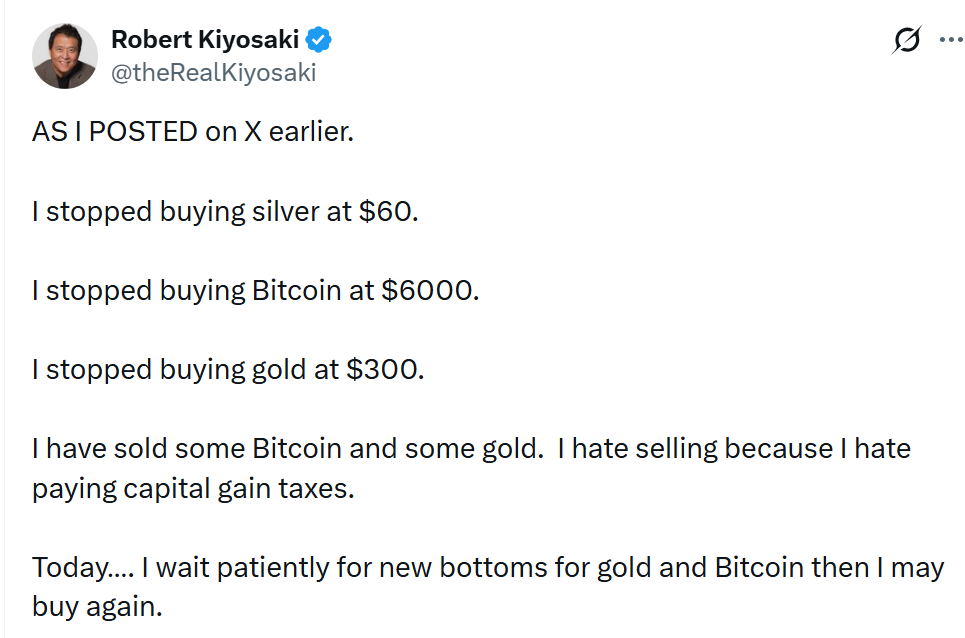

Key Post from Rich Dad: Disclosing Purchase Timeline Far Earlier Than Recent Suggestions

According to Kiyosaki's post from February 6, the key information includes:

- Bitcoin: His last purchase was at a price of $6,000, approximately five years ago (estimated around 2021).

- Gold: The last purchase price was $300, which was over twenty years ago, prior to the 2008 financial crisis.

- Silver: This is the only asset he has recently bought, with the last purchase price at $60 (price as of December 2025).

This statement quickly drew attention on social media, resulting in a "community note" added to the post, stating that on January 22, 2026, Kiyosaki publicly mentioned he was still buying Bitcoin (then priced around $90,000), silver ($96), and gold ($4,900). His remarks showed a fundamental contradiction within just two weeks.

The Gap Between Long-Term Advocacy and Actual Behavior

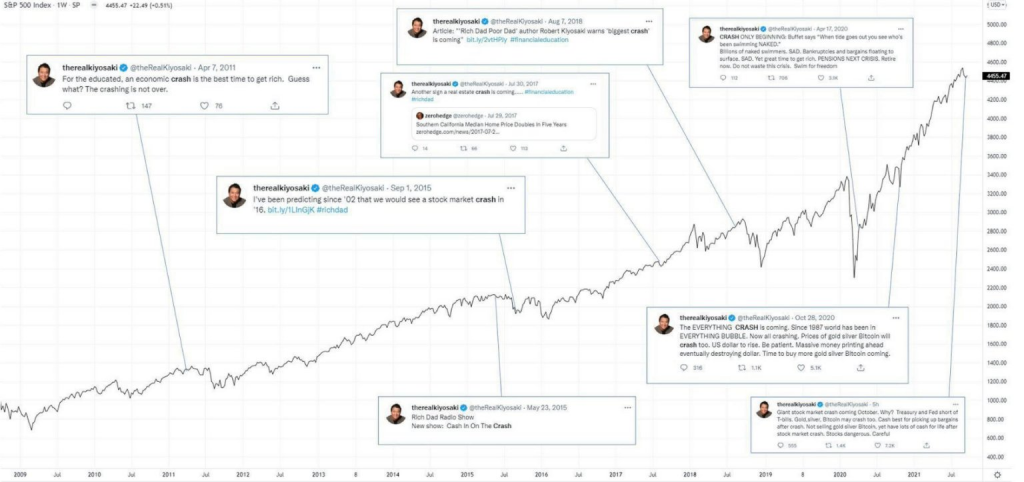

Kiyosaki has consistently encouraged followers in public forums and on social media to ignore price fluctuations and continue buying gold, silver, and Bitcoin. During the market surge from 2025 to early 2026, he frequently posted updates indicating he was "buying." For instance, when Bitcoin approached $120,000 in July 2025, he still made similar remarks.

This recent "revelation" has left many followers confused and reignited questions about his motives. Over the years, Kiyosaki has faced numerous criticisms as a "fraud" or "speculator," and this incident has resurfaced such accusations.

Market Background: Recent Weak Performance of Investment Portfolio

At the time of Kiyosaki’s controversial comments, his favored asset portfolio was experiencing significant declines:

- Bitcoin had fallen from its January peak and was around $64,756 at the time of writing, erasing all gains since 2024 and dropping below its 2021 peak.

- Ethereum (an asset Kiyosaki has mentioned less frequently but acknowledges holding) dropped to about $1,870.

- Gold and silver fell back to approximately $4,860 and $74, respectively. Although both have risen in 2026 so far, they have significantly dropped in the short term from their peaks.

Motivation Questions: Is There an Intent to Influence the Market?

Some market observers suspect that Kiyosaki's statements, which contradict his long-standing advocacy, may have ulterior motives. His actions resemble those of certain public figures who attempt to attract retail investors to drive up asset prices for their own benefit before selling at a high point. While such motives are difficult to prove, the timing of his statements, coinciding with poor performance of his investment portfolio, raises suspicions.

Conclusion: The Responsibility of Public Figures

This incident highlights the significant gap that may exist between influential financial public figures’ public statements and their actual behaviors. For investors at large, it is essential to base any investment advice on independent judgment and transparent information, rather than blindly following a single individual's claims. Kiyosaki's social media post has placed him at the center of a credibility controversy, and how he responds in the future will continue to be scrutinized by the market and public opinion.