In-depth comparative analysis: Bitcoin's 2025 crash vs. 2022 collapse

As Bitcoin's price has dropped 30% from an all-time high of about $126,200 in October, the market faces a crucial question: Is the Bitcoin plunge in 2025 the end of a bull market, or a normal correction within the cycle?

Key Points on the Bitcoin Collapse in 2025:

Reasons for the 2022 Collapse: In May 2022, when the U.S. Federal Reserve raised interest rates by 0.5%, Bitcoin was priced at approximately $37,700. Subsequently, the collapse of the TerraUSD stablecoin and its sister coin, Luna, led to losses exceeding $40 billion in the market, shocking the entire industry. By May 12, Bitcoin had fallen to $28,900, while Ethereum dropped from $2,779 to around $1,700. A series of subsequent collapses occurred, including Celsius freezing withdrawals, Three Arrows Capital's bankruptcy, and FTX declaring bankruptcy in November. By this time, Bitcoin's price had plummeted to $15,742, and Ethereum to $880, with the total value of the crypto market losing over $1 trillion. From peak to trough, Bitcoin's decline approached 59%. This sell-off was exacerbated by deleveraging, debt defaults, and high leverage, giving rise to what many termed the "crypto winter."

Reasons for the 2025 Collapse: In contrast, the price correction in 2025 primarily stemmed from external macroeconomic factors. On October 10, 2025, U.S. President Donald Trump announced a 100% tariff on imports from China, prompting an immediate market reaction; in 24 hours, the crypto market lost nearly $400 billion, setting a record for the largest single-day loss. After reaching $126,200 on October 6, Bitcoin fell to about $110,000 by the end of the month and further declined to around $85,000 by late November. By mid-December, Bitcoin's price stabilized between $88,000 and $89,700. November's decline of 25% marked the worst month for Bitcoin since 2022. However, unlike in 2022, there were no significant collapses of major crypto projects during this period, stablecoins did not lose their peg, and major exchanges did not fail. The damages were primarily due to macroeconomic uncertainty rather than internal weaknesses, which is a key distinction between the two collapses.

Price Trends: Comparing 2022 and 2025

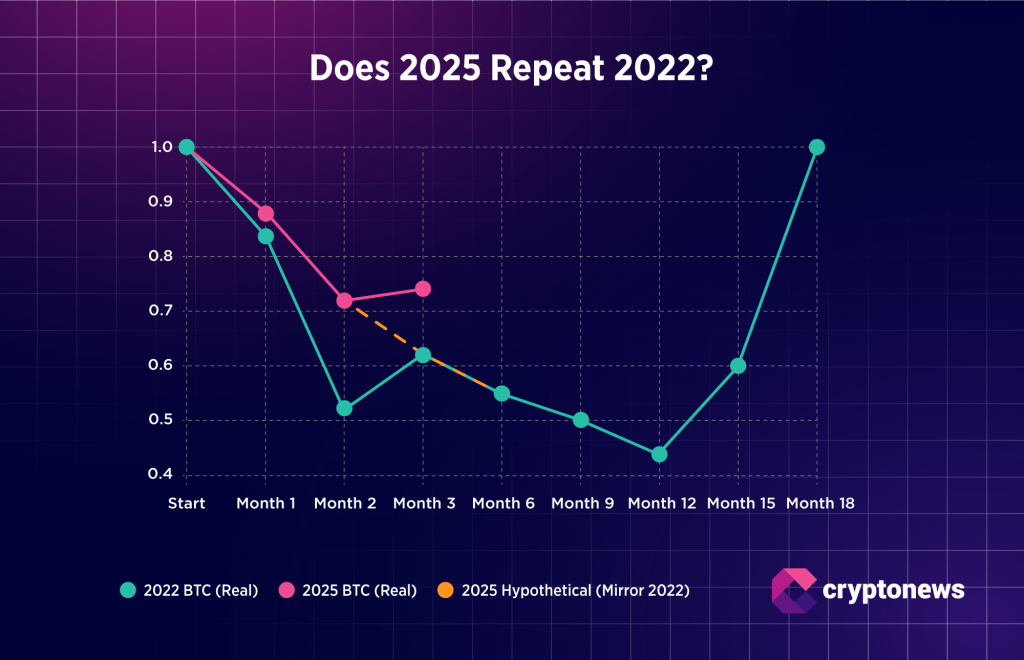

To compare these two cycles, we standardized the data at their triggering points (May 3, 2022, and October 10, 2025).

- First Month: The price drop in both cycles was similar.

- Second Month: Clear divergence in price trends emerged.

- Third Month: The situation in 2025 indicated early stability, while 2022 remained unstable.

This gap shows that the correction in 2025 was less severe and had not yet entered a full-blown sell-off phase.

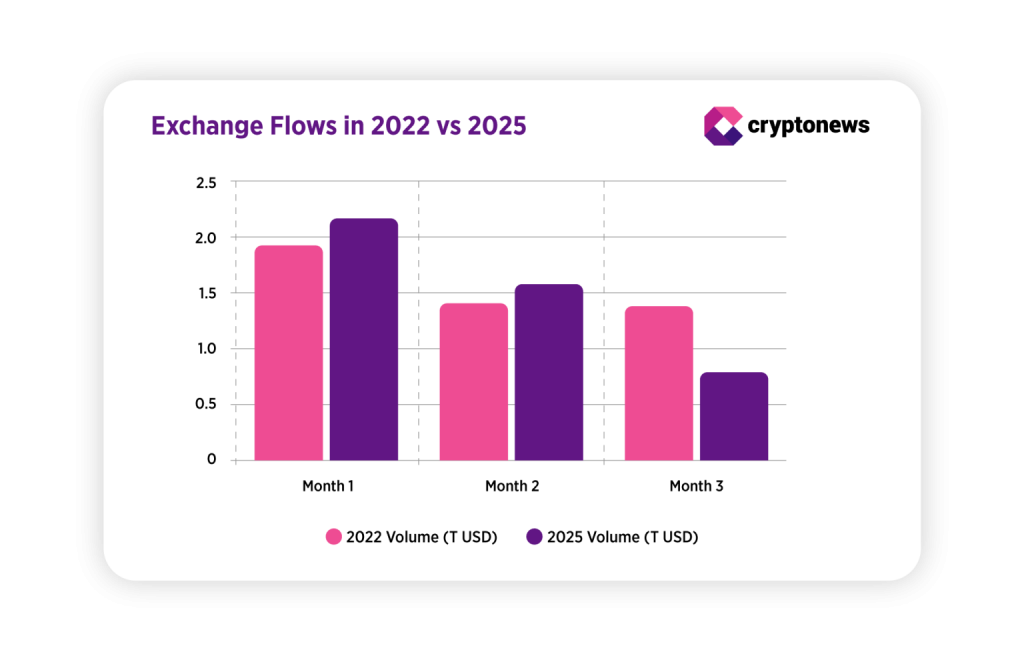

Exchange Liquidity Indicators

Exchange liquidity accurately reflects market sentiment. When the number of Bitcoins flowing into exchanges increases, it usually indicates that investors are preparing to sell; conversely, if outflows increase, it suggests potential accumulation or reduced intent to sell. In 2022, following the Terra/Luna collapse, there was a significant net inflow in May and June of about 150,000 Bitcoins. During this time, the spot trading volume on centralized exchanges fell from $1.94 trillion in May to $1.41 trillion in June and further to $1.39 trillion in July, indicating a drop in trading participation amidst a deepening bear market.

In 2025, the situation appeared more stable. November's total inflow reached about 580,000 Bitcoins, but net flows showed a negative balance, indicating that the outflow of Bitcoins from exchanges exceeded inflows, typically signaling potential stable accumulation. The reserves on exchanges dropped to 2.76 million Bitcoins, suggesting long-term holders and institutions are moving assets off exchanges.

If 2025 Recovers Like 2022, How Long Will It Take?

Bitcoin's full recovery after the 2022 collapse took 16 to 20 months, with more than a year to rebound from the bottom. If the 2025 cycle follows a similar timeline, recovery may take 12 to 18 months. Bitcoin could test the 0.62 standard level around $77,500 again before turning. However, the current market structure appears more solid, and liquidity is deeper, without a specific crypto crisis; yet multiple external factors could still influence the recovery speed.

Outlook for 2026

The outlook for 2026 remains highly uncertain. While some analysts believe there is room for rate cuts next year, recent Federal Reserve forecasts suggest there may be only one rate reduction. Policymaker opinions are increasingly divided. Any loosening of policies or liquidity support could help risk assets, although recent dynamics show that Bitcoin's response is not always a linear increase. With ETF demand stabilizing, some forecasts (including those from JPMorgan) still describe scenarios where Bitcoin reaches higher levels.

At the same time, persistent inflationary pressures, strong U.S. economic data, and geopolitical tensions may delay policy shifts or maintain tight conditions. If ETF inflows decrease or institutions become more cautious, Bitcoin's price may remain flat for some time rather than generate a new upward trend.